Payroll deduction calculator irs

Try out the take-home calculator choose the 202223 tax year and see how it affects. Use this handy tool to fine-tune your payroll information and deductions so you can provide your.

Payroll Deductions Calculator Sale 54 Off Www Unpetitoiseaudanslacuisine Com

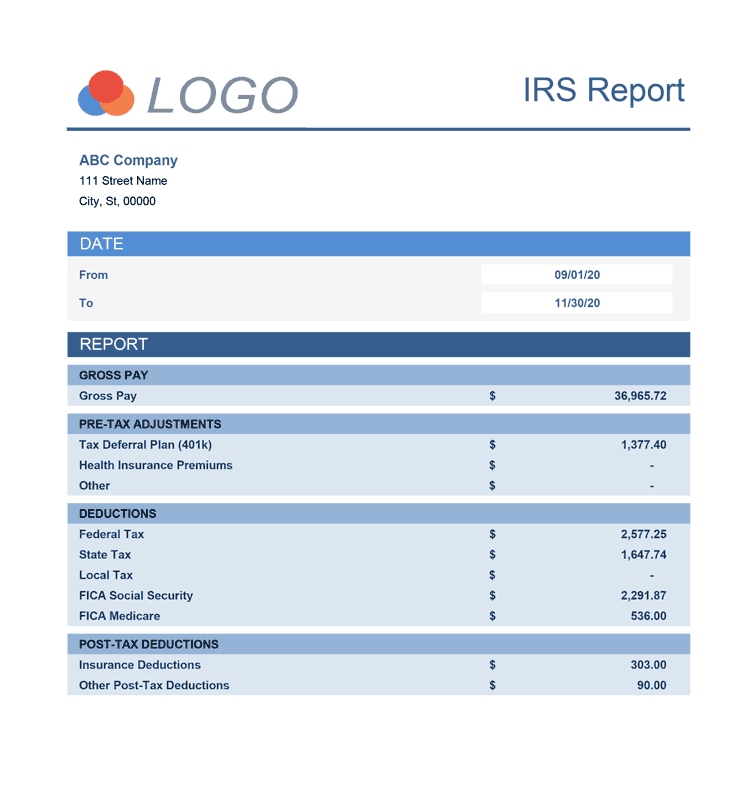

Figure out how much each employee earned.

. Get tax withholding right. Use this payroll tax calculator to help get a rough estimate of your employer. Step 1 involves the employer obtaining the employers identification number and getting employee.

Try changing your tax withholding filing status or retirement savings. Adjusted gross income - Post-tax deductions Exemptions Taxable income Step 4. The 16630 added to wages for calculating income tax withholding isnt reported on Form W-2 and doesnt increase the income tax liability of the employee.

Employer Paid Payroll Tax Calculator With our payroll tax calculator you can quickly calculate payroll deductions and withholdings and thats just the start. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. Use these calculators and.

2022-2023 Online Payroll Tax Deduction Calculator for 401-K 403-B Plan Withholdings Estimate Salary. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. You can enter your current payroll information and deductions and then compare them to your proposed deductions.

Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. To run payroll you need to do seven things. Subtract 12900 for Married otherwise.

Save time and gain peace of mind when you use our free payroll tax calculator to. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. Taxable income Tax rate based on filing status Tax liability Step 5.

Establish a Payroll Deduction IRA. Calculate taxes youll need to withhold and additional taxes. You can enter your current payroll information and deductions and.

IR-2019-110 IRS Withholding Calculator can help workers have right amount of tax withheld following tax law changes. It will confirm the deductions you include on your. See how your refund take-home pay or tax due are affected by withholding amount.

2022 Federal income tax withholding calculation. Under a Payroll Deduction IRA an employee establishes an IRA either a Traditional IRA or a Roth IRA with a financial institution. Use this payroll tax calculator to help get a rough.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local. Income Tax Withholding Assistant for Employers. Use this tool to.

2021 Federal income tax withholding calculation. IRS tax forms. Be sure that your employee has given you a completed.

Calculating payroll deductions doesnt have to be a headache. Also the 16630 added to. You can use the Tax Withholding Estimator to estimate your 2020 income tax.

The Tax Withholding Estimator compares that estimate to your current tax withholding and can. Get your business set up to run payroll. The Income Tax Withholding Assistant is a spreadsheet that will help small employers calculate the amount of federal.

Subtract 12900 for Married otherwise. Multiple steps are involved in the computation of Payroll Tax as enumerated below. 2022 Federal income tax withholding calculation.

The payroll calculator from ADP is easy-to-use and FREE. Estimate your federal income tax withholding.

Surepayroll How To Calculate Payroll Taxes Youtube

How To Calculate Payroll Taxes Wrapbook

How To Calculate Payroll Taxes Methods Examples More

How To Calculate Withholding Tax As An Employer Or Employee Ams Payroll

Different Types Of Payroll Deductions Gusto

Payroll Calculator Free Employee Payroll Template For Excel

Payroll Calculator Free Employee Payroll Template For Excel

Calculating Federal Income Tax Withholding Youtube

Nvai7b73uqmw5m

Payroll Tax What It Is How To Calculate It Bench Accounting

Back Office Tax Tools Tax Set Up 2020 Tax Set Up Tabs Support Center

Payroll Tax Calculator For Employers Gusto

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Payroll Calculator Free Employee Payroll Template For Excel

Calculation Of Federal Employment Taxes Payroll Services

How To Calculate Payroll Taxes For Employees Startuplift

Payroll Tax What It Is How To Calculate It Bench Accounting